U.S. Senator expresses CBDC concerns, supports Bitcoin

In recent remarks at the Bitcoin Policy Summit, the Tennessee Republican expressed strong concerns about Central Bank Digital Currencies (CBDCs), labeling them as potential spy tools for government oversight.

“Central Bank Digital Currencies are essentially a way for the government to have a peephole into everyone’s personal finances,” Blackburn said.

She argued that such digital currencies could enable unprecedented access to individual financial transactions, thereby increasing the potential for governmental control over personal freedoms.

You might also like:

BlackRock’s Bitcoin ETF draws $73m amid sluggish market

In contrast, Blackburn praised cryptocurrencies like Bitcoin (BTC) for their decentralized nature and role in promoting financial autonomy.

“One of the things that we look at is the freedom aspect, the privacy aspect of Bitcoin. That’s a very good thing,” she said.

The senator’s comments stem from many governments exploring or implementing digital currencies. Proponents argue that CBDCs can make financial systems more efficient and inclusive. However, critics like Blackburn warn that they could also increase government surveillance and threaten individual liberties.

Back in February, former President Donald Trump, historically critical of cryptocurrencies, showcased a notable shift, endorsing Bitcoin’s rising popularity, particularly among youth and African American communities. On Fox News’s The Ingraham Angle, Trump acknowledged Bitcoin’s momentum, suggesting it might necessitate some regulatory oversight.

“Many people are embracing it,” he said, marking a significant pivot from his earlier views, in which he labeled Bitcoin a scam.

Blackburn and Trump’s approval indicates more regulatory approval among people within the U.S. government toward the decentralized nature of Bitcoin.

Read more:

Can Hong Kong’s spot Bitcoin ETFs boost BTC price?

Follow Us on Google News

READ MORE ABOUT

bitcoin

cbdc

privacy

Uniswap trading volume reaches $3b despite SEC claims

By Anna Kharton

By Anna Kharton

April 16, 2024 at 1:49 pm Edited by Brian Stone

Edited by Brian Stone

NEWS

Collect the article

share

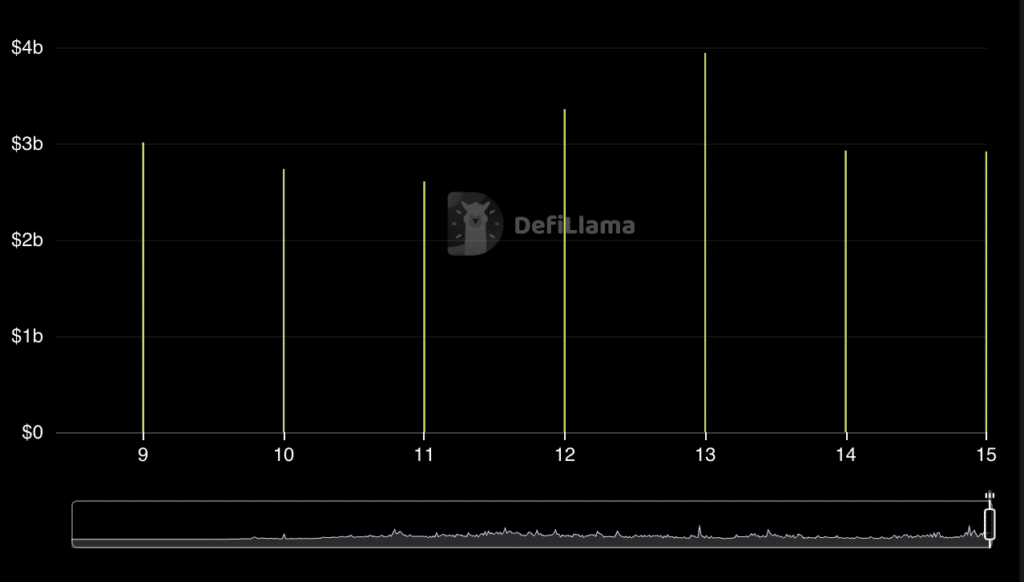

The average daily trading volume on the Uniswap decentralized exchange has approached $3 billion over the past week.

According to DefiLlama, between April 10 and April 15, Uniswap’s average daily trading volume was $3.08 billion.

Breaking the $3 billion mark indicates that DEX did not record a decline in the indicator amid news of a possible legal confrontation with the U.S. SEC. Source: DefiLlama

Source: DefiLlama

According to available statistics, the increased risk of legal confrontation with the SEC has not deterred users. There was no significant decline in trading volume; this figure has remained from $2.6 billion to $3.9 billion for the last five days.

As of April 16, the total value locked (TVL) was $6.62 billion, and the platform’s market capitalization was $5.65 billion.

You might also like:

Uniswap all-time trading volume hits $2t

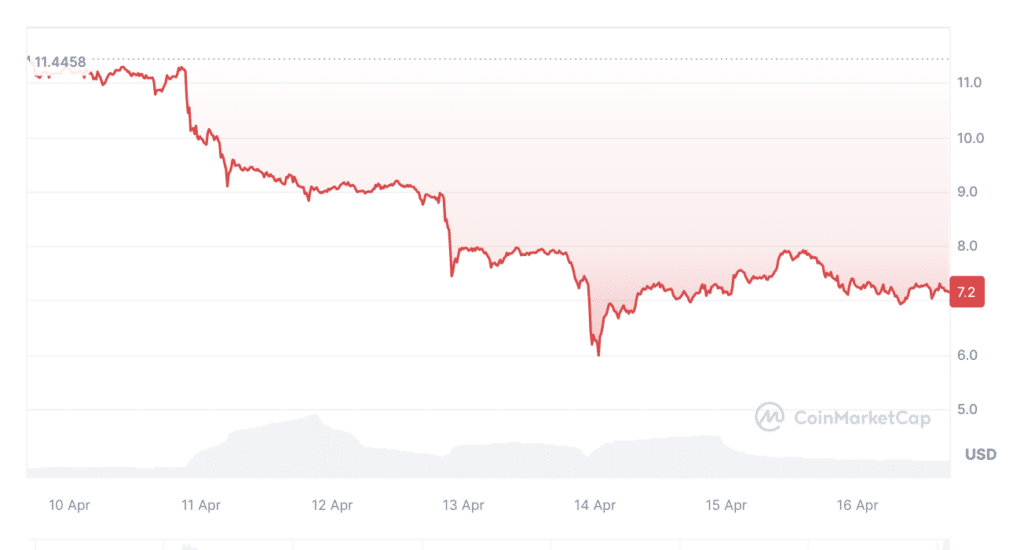

However, the Uniswap token (UNI) rate has not boasted positive dynamics. Over the past week, the token’s value fell by 37.5%, according to CoinMarketCap. On April 10, the UNI price was $11, but dropped below $6 three days later. At the time of writing, UNI is trading at $7.15, having fallen in price by 8% over the last 24 hours. Source: CoinMarketCap

Source: CoinMarketCap

On April 10, Uniswap CEO Hayden Adams stated that the agency had provided his team with a Wells notice. Typically, such a letter is sent before filing a formal lawsuit or to give a final opportunity to refute any allegations.

The exchange also increased its commissions after news of a possible SEC lawsuit from 0.15% to 0.25%.