SEC launches campaign to classify Ethereum as a security

The Ethereum Foundation, an organization that supports the development of the Ethereum ecosystem, has just confirmed that it is being contacted to cooperate in the investigation by an anonymous management official.

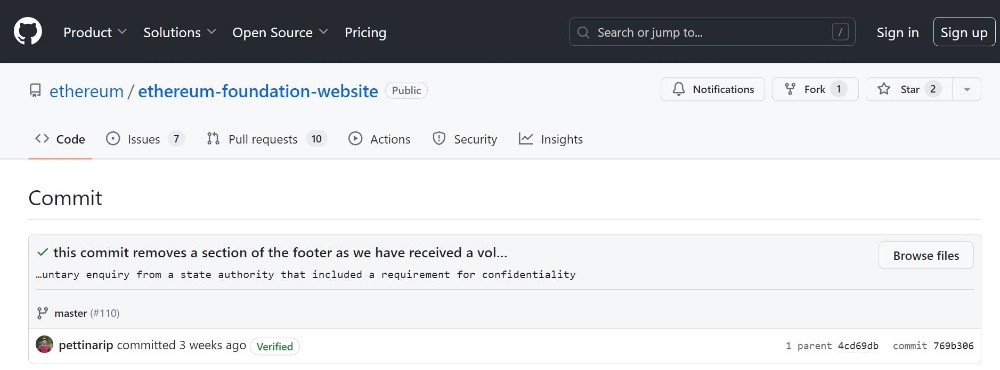

According to an edit on February 26, 2024 on GitHub, the Ethereum Foundation said "we have just received a request to cooperate in an investigation from a management unit and the request includes a condition to keep the information confidential".

Before being asked to cooperate in the investigation, the Ethereum Foundation's website had the following specific headline:

"Ethereum Foundation has never received any request from any government official that included a condition not to disclose contact information. The organization will publish all requests and related information from any governing organization. any reason is outside the scope of business activities."

The above headline was removed on February 26, coinciding with the Github mentioned above being updated.

Pablo Pettinari, front-end developer at the Ethereum Foundation, said:

"This adjustment is to remove the footer (the part at the bottom of the page when we receive a request for cooperation from a management official, whose specific identity cannot currently be disclosed because of information confidentiality requirements."

The GitHub correction shows that the Ethereum Foundation is being asked to cooperate with the investigation

The update also removed the "canary" image on the organization's website, implying that the Ethereum Foundation has never received a request for cooperation from any organization without having to publish detailed information.

The latest news above coincides with Ethereum's recent Dencun upgrade, with structural changes to help reduce transaction costs on Layer-2.

According to sources from a lawyer involved in the case, the Ethereum Foundation may be working with the US Securities and Exchange Commission (SEC) through the Swiss government, where the organization is registered. . Specifically, the SEC is said to be considering ETF proposals for Ether. However, analysts are not very optimistic about the possibility of these proposals being approved by officials by the May deadline.

Shortly after, it was reported that the SEC was launching a campaign to classify ETH as a security, according to Fortune.

ETH price is showing signs of a negative reaction after news that the Ethereum Foundation was contacted by an unnamed government for investigation. In addition, ETH has also decreased by 17.5% since Dencun was successfully deployed on March 13.

The news deals another blow to hopes of an Ethereum spot ETF approval this coming May, after the SEC had previously approved a series of Bitcoin spot ETFs.

The "unnamed regulator" investigating the Ethereum Foundation is the SEC

According to Fortune, the United States Securities and Exchange Commission (SEC) is waging a vigorous legal campaign to classify Ethereum, the second most popular cryptocurrency in the crypto market, as a security.

According to the source, a number of companies in the US have received subpoenas from the SEC, requesting to provide all documents and financial records related to transactions between the companies and the Ethereum Foundation, the organization that supports the development of the system. Ethereum ecosystem.

These companies asked the press not to be identified because they "did not want to get into trouble with SEC Chairman Gary Gensler", whom they described as having a "hostile personality".

Fortune's source also revealed that the SEC began investigating the Ethereum Foundation through the Swiss government, where the organization is registered, right after Ethereum upgraded The Merge to switch from "Proof-of -Work (PoW)" to a new governance model called "Proof-of-Stake (PoS)" in September 2022.

This information appeared "coincidentally" right after the Ethereum Foundation confirmed that it was being contacted to cooperate in the investigation by an unnamed management official believed to be the SEC.

The SEC has long expressed its stance against PoS coins

As reported by Coin68, the SEC under the direction of current Chairman Gary Gensler has long expressed its stance against Proof-of-Stake coins, calling them a form of disguised securities.

Since "The Merge" event, Mr. Gary Gensler believes that all Ethereum transactions are under US jurisdiction and views the ETH staking mechanism as a securities investment contract. While the SEC Chairman has repeatedly ruled out this possibility for Bitcoin.

The securities argument is also frequently used by this agency in past legal actions such as:

· Former CEO Sam Bankman-Fried and FTX's FTT token;

· Do Kwon and Terraform Labs;

· Mango Markets hacker Avraham Eisenberg and MNGO token;

· Kraken's staking service;

· Lending unit Genesis and Gemini exchange;

· Paxos and Binance's BUSD stablecoin;

· Voyager investment platform and Binance.US exchange.

· File a lawsuit against America's largest trading platform Coinbase.

Even in the announcement of the approval of the Bitcoin spot ETF, the SEC still maintained its stance of not supporting crypto, and only Bitcoin is considered an asset, while other cryptocurrencies have not yet escaped being considered securities. .

The SEC also has an "ally" in Ms. Letitia James - Attorney General of New York - accusing Ethereum of being an unregistered security and that its creators, including Vitalik Buterin, did not comply with federal law, in the lawsuit. against KuCoin exchange on March 9, 2023.

However, the head of the Futures Trading Commission (CFTC), Rostin Behnam, has a different view, considering most stablecoins to be commodities and Ethereum not a security. And if referred to The Howey Test - the basis for the SEC to classify a project token as a security or not - the test's argument is not convincing enough to prove "Ethereum is a security".

This news directly "dealt another blow" to the crypto community's hopes as they waited for the SEC to approve Ethereum spot ETF applications from investment funds in the United States, which the agency did. to approve a series of Bitcoin spot ETFs in January.