Creating an Airdrop Snowball Effect

Greetings farmers and degens!

As you might know, there are several different types of airdrops you can take part in. There are the testnet ones with testnet tokens and then there are those that require you to interact with the platform using real assets to create transactions that are stored in the blockchain.

In this article, I will focus on stake-based airdrops and more specifically, on creating a snowball effect.

Starting Out

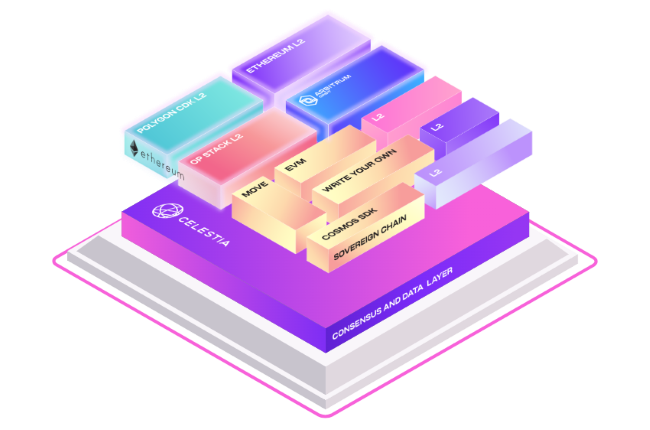

To begin with, you don’t necessarily need a lot of initial capital to start farming airdrops. What you need, is to find the right project with a lot of future airdrop potential. I started farming in late autumn last year and I don’t know if I was lucky but I started with one of the best stake-based farming projects currently. Celestia is a modular data availability network that makes it easy for anyone to securely launch their own blockchain. This means projects built on Celestia are very likely to airdrop a percentage of their tokens to those who stake, and therefore support and help to make Celestia more decentralized.

Celestia is a modular data availability network that makes it easy for anyone to securely launch their own blockchain. This means projects built on Celestia are very likely to airdrop a percentage of their tokens to those who stake, and therefore support and help to make Celestia more decentralized.

After reading a lot of positive things about Celestia and checking out the other projects building on Celestia, I bought a modest amount of 12 $TIA tokens and staked them on my Keplr wallet. As a nice bonus for doing so, there’s also a ~15% APR but that’s not the main thing.

To be eligible for airdrops, the important thing is the time when the snapshot is taken and also, in some cases, the amount you have staked. For example, I missed the SAGA airdrop even though I was staking before the snapshot date because the criteria were set pretty high — 35 TIA was the minimum stake. Luckily, some airdrops have much lower minimum requirements.

Snowball

The airdrop that got my snowball rolling, and provided me with much-needed liquidity, was the Dymension drop for $TIA stakers. My allocation was worth about $1,200 at launch and I sold half of it shortly after that.

I then staked the other half (over 100 DYM) on the same day to secure my position for future airdrops and this time for $DYM stakers.

To The Mainnet

To further build some mass for my snowball, I bridged about $100 to the Ethereum mainnet (sigh…), paid the fees, and then bridged them to Ether.fi where I started farming for their native token $ETHFI.

Despite the horrible fees, this proved to be an excellent choice as last week $ETHFI dropped and I was eligible. You can read more about it in my previous blog post but in short, the team changed the allocation for lower-tier stakers such as me, and the amount of ETHFI I was eligible for was raised from 24 tokens to 175.

By the time of writing this, the price of $ETHFI is at $4.16, making my airdrop worth $728.

NIM

So, the DYM airdrop had already given some good rewards but I believe it’ll turn out to be a gift that just keeps on giving. Earlier this week DYM stakers noticed an announcement made by NIM. This AI and the gaming-focused network released their airdrop eligibility checker and my DYM stake is eligible for 114 NIM tokens.

First of all, I’m very pleased with how the NIM team had done this airdrop since all we needed to do was to paste our DYM address — no wallet connect required or claiming required.

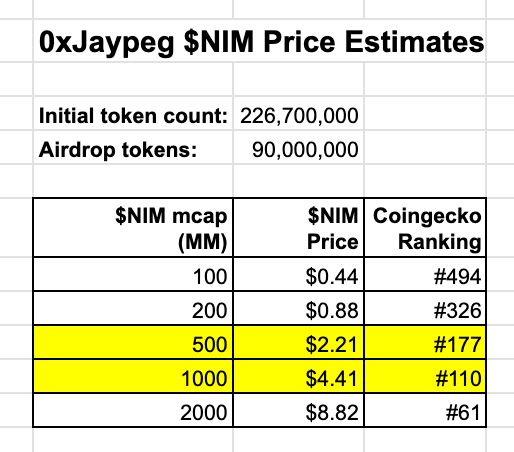

The speculation about the $NIM price on TGE started shortly after.

On X, there seems to be a strong belief that the price could be somewhere between $2–4 which would make this, if not as good as DYM or ETHFI, but a very decent $200 — $400 airdrop.

To be honest, the NIM airdrop came out of the blue, and haven’t had time to look that much into the project so I haven’t yet decided if I’ll go with my usual 50/50 sell/stake strategy.

Is It Too Late To Catch TIA & DYM Trains?

No! There are still many potential airdrops in the line for both TIA and DYM. Just recently I found these two very useful sites to keep up with the upcoming airdrops for not only those two assets but for others such as $ATOM as well:

I have a list of my own on Notion to keep track of drops I’m eligible and all of these are at least confirmed(TIA = pink, DYM = brown):

The blue ones are for $ATOM stakers which by the way is another solid choice if you are farming airdrops on the Cosmos ecosystem.

Conclusion

Honestly, sometimes I feel like the Cosmos staked-based airdrop strategy is the best-kept secret of this bull run and I wonder why everyone isn’t doing it.

Compared to active airdrop farming, such as grinding with bridges or doing testnet tasks, this kind of passive staking strategy is my favorite one. If I wasn’t so deep in the whole airdrop scene, and I would have more capital, I’d focus my time and energy solely on these ones.

That being said, the other way to farm airdrops can also potentially lead to some massive gains as the whole narrative is just heating up.

That’s all for today, hope you find some inspiration from this one, and be sure to check out my other airdrop links below 👇 and follow for more! 🙏🪂🌻

Thank you for reading!

Ongoing Airdrops:

🔸 Elys Network — easy 1 minute/day testnet

🔸 Grass — perhaps the easiest way to gain exposure for a potentially very big airdrop!

🔸 Tabi — easy tasks. Backed by Binance. Invite codes: zYvX3 , p5S2p , JOsHn , y8tCU , kRHdF

🔸 DFlow — bridge a minimum of $5 Solana tokens (invite codes: B9M3HK, QW2WI7, 466GC4)

🔸 MilkyWay — stake TIA farm MilkyWay airdrop

🔸 Archway — join the Archway airdrop waitlist

🔸 GRVT ZkSync mystery box — just log in and claim your first mystery box

🔸 deBridge— bridge assets across L1s & L2 (including Solana!)

🔸 Ether.fi — stake ETH for Points & EigenLayer points

🔸 Mode airdrop

Disclaimers:

Thumbnail background image made with Canva

This article contains referral links — remember to DYOR, and double-check URLs!